Investing with Market Cap in Mind

A company’s market capitalization (or market cap), calculated as the number of outstanding shares multiplied by the price per share, is a measure of its size and value. Small-cap stocks continued to trail the performance of large caps of the S&P 500 Index in 2024, partly because small companies are more likely to depend on floating-rate debt to fund their growth. But now that the Fed has started to cut interest rates, the prospects for smaller companies may be looking up, as many are expected to benefit from falling debt payments and rising earnings in 2025.1

Small, midsize, and large companies often perform differently in response to economic and market conditions, which can shift unpredictably. For this reason, holding stocks in companies of varied sizes through mutual funds or exchange-traded funds (ETFs) could help diversify your portfolio and reduce volatility. It may also allow you to pursue a broader range of growth opportunities at a lower cost.

Sizing up stocks

Large companies tend to be long-established and more complex than smaller companies. They also have greater financial resources to help them weather economic downturns, which is why large-cap stocks are considered more stable. However, many large U.S. companies conduct business overseas, which makes their stock prices more sensitive to global economic forces, including currency exchange risk and political risks unique to the countries they do business in.

In the past, large caps were considered to have less growth potential. But over the last decade, the dominance of the largest technology stocks challenged this notion, and they have expanded their influence on S&P 500 returns. At the beginning of 2025, just seven mega caps made up nearly 34% of the index’s total market cap.2

Small companies are often limited to a single line of business or might be startups selling new products that are still unproven. They may struggle more in tough times, but when they succeed, they can experience rapid growth in revenue and profits. As a result, small caps might offer the highest growth potential of the three classifications, though they are typically the most risky and volatile class of stocks.

Midsize companies may have longer track records and better funding options than small companies, and they might react more nimbly to market opportunities than larger competitors. Thus, midcaps tend to fall between the other two classes in terms of growth potential and risk.

Types of funds

There are two types of funds that invest based on market cap. Index funds are passively managed. They track a particular index and aim to match its performance by buying and selling stocks in the same proportions. Actively managed funds include stocks that are chosen by professional analysts according to the fund’s specified guidelines and objectives.

Small-cap and midcap stocks tend to be traded less frequently than large caps, so the market can be inefficient. Active managers try to beat the indexes by performing research to identify companies that are growing quickly or may be overlooked and undervalued.

Performance Perspective

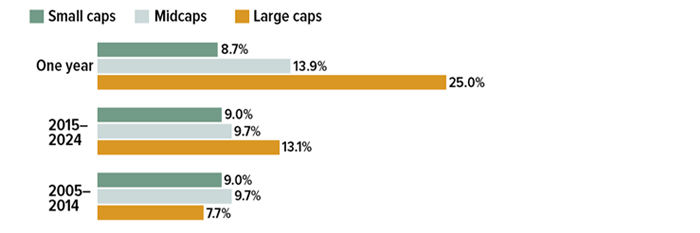

Large-cap stocks have produced the highest returns over the past year and decade. However, midcaps and small caps beat large caps during the previous 10-year period.

Annualized returns

Source: London Stock Exchange Group, 2025, for the period 12/31/2004 to 12/31/2024. Large-cap stocks are represented by the S&P 500 Composite Total Return Index, midcap stocks by the S&P 400 Midcap Total Return Index, and small-cap stocks by the S&P 600 SmallCap Total Return Index. Expenses, fees, charges, and taxes are not considered and would reduce the performance shown if they were included. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in an index. Rates of return will vary over time, particularly for long-term investments. Actual results will vary.

There is no standard way to classify stocks, but the following indexes provide a helpful comparison and are commonly used as benchmarks for fund performance.3

S&P 500: Median market cap of $37.0 billion

S&P MidCap 400: Median market cap of $6.8 billion

S&P SmallCap 600: Median market cap of $2.0 billion

Russell 2000: Median market cap of $1.0 billion

Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. The investment return and principal value of stocks and funds fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.